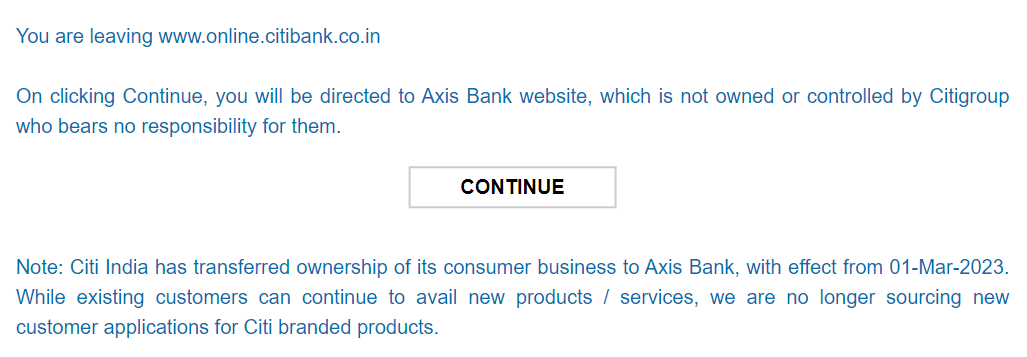

If you’re trying to secure a private loan to cover your expenses, Citibank offers a viable option. However, it is critical to be aware that as of March 1, 2023, Citibank’s personal loan commercial enterprise, at the side of its client banking operations, has been transferred to Axis Bank. Consequently, if you’re interested by making use of for a Citibank personal mortgage, you may now want to go through Axis Bank. This manual will provide unique statistics on a way to apply online for a Citibank private loan, overlaying hobby costs, benefits, eligibility standards, and important files. Stay with us to explore all of the info you want to understand about Citibank private loans in 2024.

Citibank Personal Loan Interest Rate

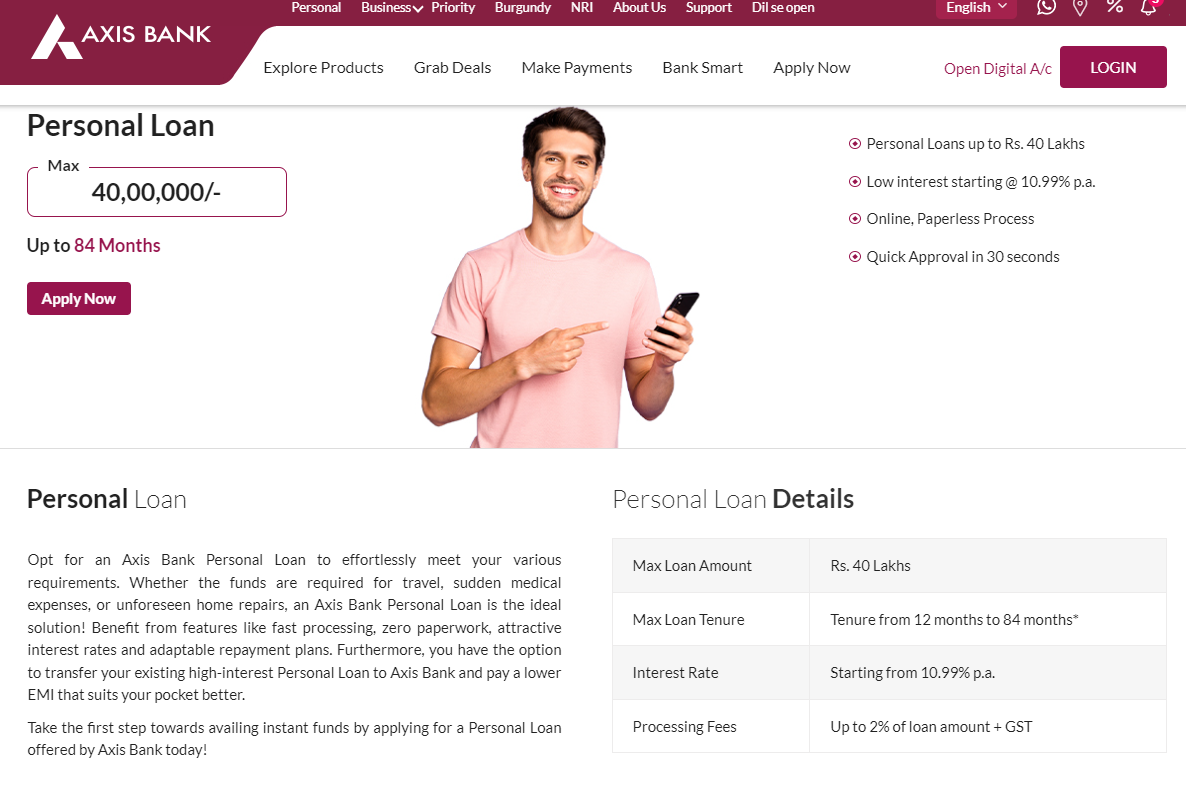

Since Citibank’s private mortgage offerings had been taken over through Axis Bank, the relevant hobby rates are those set by way of Axis Bank. The hobby fee for a Citibank personal loan starts at 10.99% in step with annum. However, this price can range primarily based on several factors, together with the applicant’s earnings, CIBIL score, preceding financial statistics, and process profile.

Citibank Personal Loan Amount

For 2024, beneath the Citibank private loan scheme (now controlled by means of Axis Bank), you can avail a mortgage starting from at least ₹50,000 to a most of ₹40 lakh. The loan tenure may be as short as 1-12 months or as long as five years, with a most processing fee of 3%.

Read Also – Instant Cash Solution: Get ₹5 Lakh from PhonePe in Just 10 Minutes – No Bank Visit Needed!

Benefits of Taking a Personal Loan from Citibank

Applying for a non-public loan from Citibank offers several advantages:

- High Loan Amount: Borrow as much as ₹40 lakh to meet your financial wishes, whether or not small or huge.

- Affordable Rates: Access substantial mortgage quantities at aggressive hobby fees.

- Flexible Application Process: Apply either on line or offline in line with your comfort.

- Quick Approval: Benefit from an immediately loan facility with minimal documentation required.

Eligibility and Documents for Citibank Personal Loan

To be eligible for a Citibank non-public loan, now processed via Axis Bank, candidates ought to meet the subsequent criteria and offer the vital documentation:

Eligibility Criteria:

- Applicants must have a stable supply of earnings.

- Both salaried people and self-hired professionals can follow.

- Applicants should have applicable paintings enjoy.

- A appropriate CIBIL rating is essential for mortgage approval.

Necessary Documents:

- KYC Documents: Aadhar card, PAN card, and so on.

- Income Proof: Bank statements, income slips, etc.

- Employment Proof: Documents verifying employment fame and paintings revel in.

How to Apply for Citibank Personal Loan Online

Follow these steps to use for a Citibank non-public mortgage online via Axis Bank’s reliable website:

- Visit Axis Bank’s Official Website: Navigate to the Axis Bank homepage.

- Access Personal Loans Section: Click at the ‘Personal Loan’ tab, then pick ‘Apply Now’.

- Enter Required Information: Provide your mobile wide variety, name, state, type of mortgage, e mail ID, revenue type, and employment type.

- Captcha and Consent: Enter the captcha code, check the consent container, and click ‘Submit’.

- Follow-Up Call: You will get hold of a name from a bank consultant who will manual you thru the subsequent steps.

- Submit Documents: Provide the important documents as requested via the bank.

- Processing Fee: Pay the processing charge to continue with the utility.

- Loan Disbursement: Upon approval, the mortgage amount might be transferred for your financial institution account.

How to Apply for Citibank Personal Loan Offline

Alternatively, you could apply for a Citibank non-public mortgage offline with the aid of travelling the closest Axis Bank branch. Here’s how:

- Visit the Branch: Go to your neighborhood Axis Bank branch.

- Get Information: Speak with the financial institution team of workers to acquire complete facts approximately the personal mortgage.

- Fill Out the Application Form: Complete the application form furnished through the bank.

- Submit Documents: Provide the important files at the side of the finished form.

- Processing: The financial institution will procedure your utility and documents.

- Loan Approval and Disbursement: Once accredited, the loan amount can be credited on your account.

Applying for a Citibank personal mortgage has become a streamlined system via Axis Bank. With aggressive hobby fees starting at 10.99% and mortgage quantities ranging from ₹50,000 to ₹40 lakh, Citibank (via Axis Bank) gives a strong solution to satisfy your financial needs. Whether you choose the benefit of on-line applications or the warranty of an in-person visit, Axis Bank presents flexible options to facilitate your loan software process. Ensure you meet the eligibility standards and feature the important files ready for a clean and efficient utility enjoy. Embark to your journey to stable a non-public mortgage with Citibank through Axis Bank today!

FAQs

Q: What is the minimum and most mortgage amount I can apply for?

A: You can apply for a loan quantity ranging from ₹50,000 to ₹40 lakh.

Q: What is the beginning interest charge for Citibank private loans?

A: The beginning hobby price is 10.49% in keeping with annum.

Q: Can both salaried and self-hired people practice for a Citibank private loan?

A: Yes, both salaried individuals and self-employed professionals are eligible to use.

Q: How long does the mortgage approval method take?

A: The mortgage approval process is quick, specially for on-line packages, with minimal documentation required.

Q: How do I follow for a Citibank non-public mortgage online?

A: Visit the Axis Bank internet site, fill out the utility shape, publish the vital documents, and watch for the financial institution’s comply with-up.

Apply now and take the first step closer to pleasing your financial desires with a Citibank non-public loan, managed via Axis Bank.