In the ever-evolving world of virtual transactions, PhonePe has emerged as a main mobile utility utilized by hundreds of thousands for diverse monetary transactions. But did you understand that PhonePe also offers personal loans in collaboration with third-birthday party financial institutions? Yes, you heard it right! You can now satisfy your monetary wishes through making use of for a non-public mortgage through PhonePe, making it rather smooth to get a mortgage from the consolation of your own home. This comprehensive guide will walk you through the entire process of applying for a non-public mortgage via PhonePe, which include eligibility criteria, hobby charges, required files, and the step-by way of-step utility method.

What is a PhonePe Personal Loan?

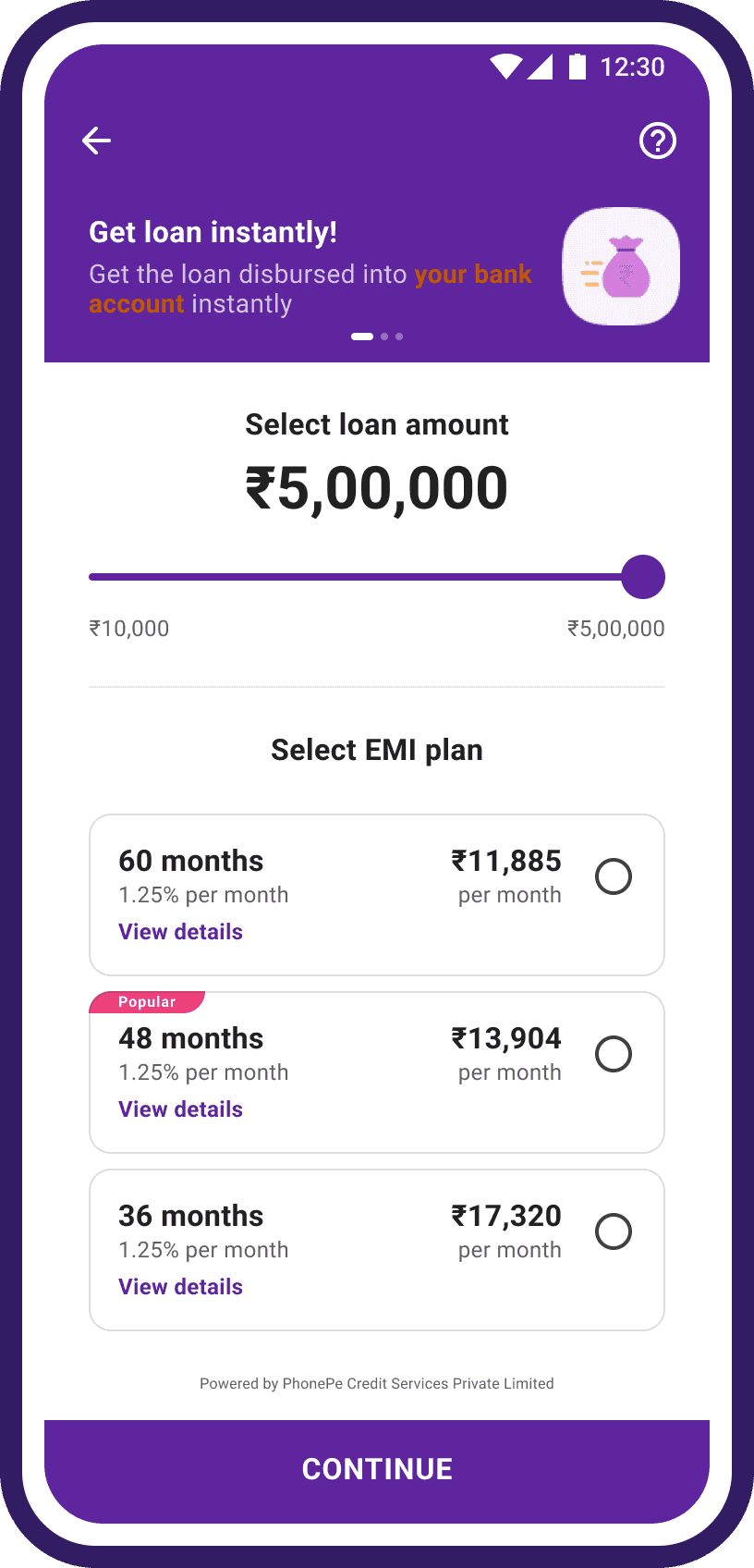

PhonePe, a widely used virtual payment platform, partners with numerous financial institutions to offer private loans to its users. This partnership lets in users to use for loans ranging from ₹10,000 to ₹5,00,000 with a short approval process, frequently inside 10 mins. These loans may be a lifesaver for meeting diverse financial wishes, from emergency expenses to planned purchases.

How to Apply for a PhonePe Personal Loan?

Step-by way of-Step Guide

Download and Register on PhonePe:

- If you haven’t already, down load the PhonePe app from the Google Play Store or Apple App Store.

- Register at the app the use of your mobile wide variety and complete the necessary verifications.

Link Your Bank Account:

- Link your financial institution account with your UPI ID on PhonePe to facilitate transactions.

Navigate to Loan Options:

- On the PhonePe dashboard, click on the “See All” option near the “Recharge & Bills” section.

- You will see various third party organizations listed below “Recharge & Pay Bills,” together with Bajaj Finance Ltd, Kredit Bee, MoneyView, Navi, and others.

Select a Partner Company:

- Choose a financial organization from which you want to take the mortgage. For instance, in case you opt for MoneyView, download the MoneyView app from the Google Play Store.

Register and Apply on the Partner App:

- Open the associate app and sign up the use of the identical cellular wide variety connected with your PhonePe account.

- Provide the vital non-public records, pick out your mortgage plan, and submit required files.

Approval and Disbursement:

- Once your utility is authorized, the loan amount could be transferred for your connected financial institution account within a few minutes.

PhonePe Personal Loan Overview 2024

- Loan Type: Personal Loan

- Loan Amount: ₹10,000 to ₹5,00,000

- Processing Fees: 2% to 8%

- Partner Companies: Flipkart, Bajaj Finserv, Kredit Bee, MoneyView, Navi, and others.

- Loan Approval Process: Online

- Official Website: PhonePe

PhonePe Personal Loan Interest Rates

The interest fees for PhonePe private loans range depending at the phrases and situations of the third party application thru which the mortgage is processed. For instance, in case you follow through MoneyView, the interest charge may be up to 15.96%. Additionally, processing costs commonly variety from 2% to 8%. Loan tenures can vary, with some companions providing repayment intervals from 3 months to 5 years.

Eligibility Criteria for PhonePe Personal Loans

To be eligible for a PhonePe non-public loan, you should meet positive criteria:

- Citizenship: Must be an Indian citizen.

- Age: Must be at the least 21 years antique.

- KYC Documents: Complete KYC documentation is needed.

- E-KYC: Your Aadhaar wide variety have to be connected to your cellular range.

- Bank Account: Must have an active bank account related to Aadhaar.

- PhonePe Activity: PhonePe ought to be actively used, and the bank account ought to be related to PhonePe.

- Income: Monthly profits must be at least ₹25,000, supported by way of an income certificates.

- CIBIL Score: A proper CIBIL score is vital.

- Financial History: Should have an amazing record of economic transactions and not be a defaulter.

Required Documents for PhonePe Personal Loans

To apply for a non-public loan via PhonePe, make sure you have the following documents:

- Aadhaar Card

- PAN Card

- Bank Account Details

- Bank Statement

- Salary Slip

- Mobile Number Linked to Aadhaar

- A Recent Selfie

FAQs – Frequently Asked Questions

How to take a personal mortgage from PhonePe?

You can’t at once get a private loan from PhonePe. You need to register at the PhonePe Business App after which practice for a loan through partnered third-birthday party apps like Bajaj Finance Ltd, Kredit Bee, MoneyView, Navi, etc.

How a whole lot mortgage can be availed on PhonePe?

You can avail of a mortgage ranging from ₹10,000 to ₹5,00,000 on PhonePe.

What is the interest rate for PhonePe non-public loans?

The interest charge for PhonePe non-public loans relies upon on the third party application used to method the loan. It can variety from 8% to 16%.

PhonePe’s collaboration with third party monetary institutions makes it less complicated than ever to apply for and get hold of non-public loans. Whether you want price range for an emergency, a big purchase, or to consolidate debt, PhonePe presents a convenient and quick answer. By understanding the eligibility standards, required files, and the software manner, you can seamlessly apply for a private loan and meet your financial desires effectively. Stay knowledgeable, be prepared, and take gain of the monetary offerings available through PhonePe to secure your financial destiny.