The Child Tax Credit (CTC) is a sizable financial support degree provided through the IRS to help families with youngsters inside the United States. For the yr 2024, there are terrific updates and expansions to the CTC, reflecting the continued efforts of the Biden administration to offer more tremendous relief to households. This comprehensive guide will cowl while CTC payments will begin, how they’ll be distributed, who is eligible, and the way to declare these monthly payments.

CTC Monthly Payments Schedule for 2024

The IRS will start the CTC month-to-month payments from July 15, 2024. Eligible families with kids underneath the age of six will get hold of $300 in step with month, while people with youngsters aged six to seventeen will acquire $250 in line with month. These bills will continue to be made on the fifteenth of each month, offering regular economic guide throughout the 12 months.

Expanded Benefits Under the New Budget

The 2024 finances, delivered by the Biden management, consists of tremendous upgrades to the Child Tax Credit. Previously, families received $2,000 per toddler, however below the new price range, the amounts have improved to $3,600 for every toddler beneath six and $3,000 for every baby elderly six and above. This increase displays the administration’s dedication to addressing the monetary desires of families, mainly in light of the financial challenges posed via the COVID-19 pandemic.

Additional Financial Support Measures

In addition to the CTC, several different monetary help applications may be available in 2024:

- Earned Income Tax Credit (EITC): Eligible recipients can expect a $600 refund.

- American Opportunity Tax Credit (AOTC): Provides a $1,000 refund for education-associated fees.

- Social Security Payment: A standard relief price of $1,800.

- Colorado TABOR Refund 2024: A state-specific refund.

- Biden Unrealized Capital Gains Tax: Another financial initiative aimed at supporting families.

- These measures, blended with the improved CTC, form a complete bundle designed to alleviate monetary pressures on households.

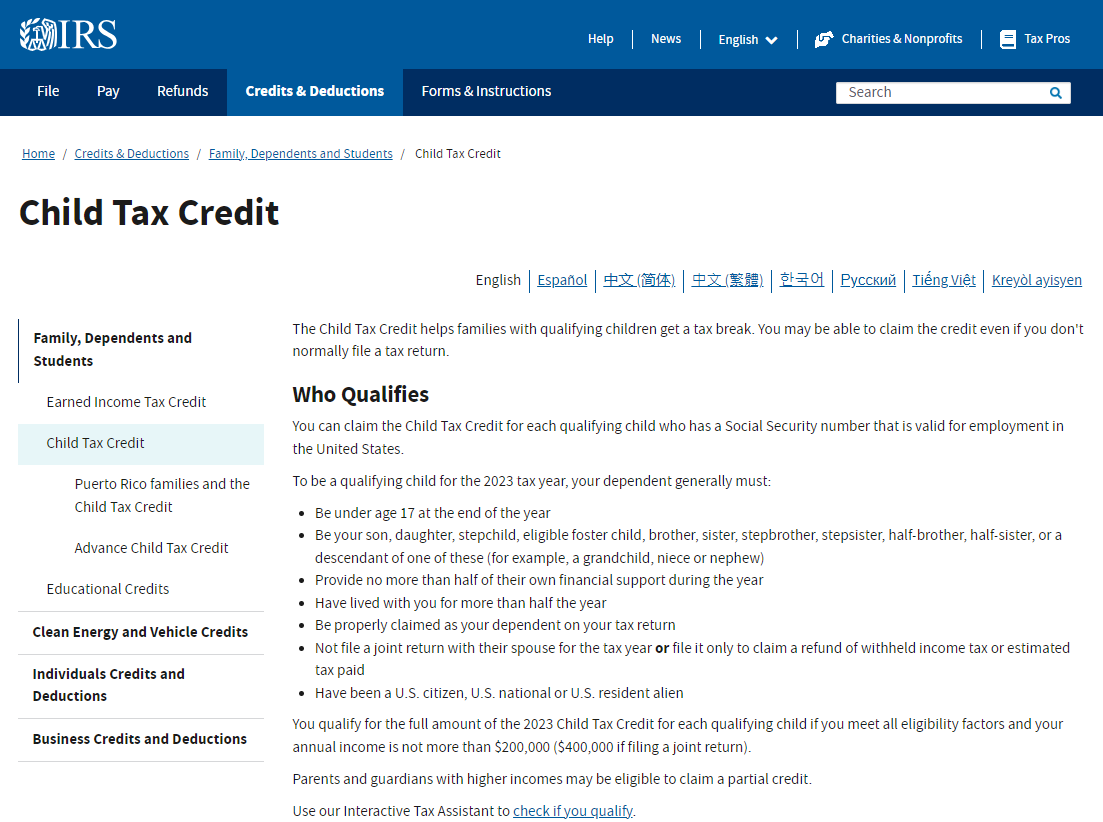

Eligibility Criteria for CTC Monthly Payments

Eligibility for the CTC month-to-month bills is primarily based on numerous criteria:

- Residency: The toddler should be a U.S. Resident.

- Age: The toddler should be under 18 years vintage at the remaining day of the tax year.

- Social Security Number: The baby should have a valid Social Security quantity and be indexed as a dependent on the tax go back.

- Relationship: The infant need to be your biological child, stepchild, foster baby, sibling, stepsibling, or a descendant of any of those (e.g., grandchild, niece, or nephew).

- Income: Families must meet precise income thresholds:

- Married couples submitting together: Adjusted Gross Income (AGI) of as much as $150,000.

- Heads of households: AGI of as much as $112,500.

- Single filers: AGI of up to $75,000.

- Residency with the Registrant: The infant must have lived with the taxpayer for more than half of the tax year in the U.S.

- Support: The taxpayer should have provided at the least half of the child’s aid at some point of the 12 months.

How to Claim the CTC Monthly Payments

To get hold of the CTC month-to-month payments, eligible households must observe a specific method:

- Check Eligibility: Use the Child Tax Credit Eligibility Assistant at the IRS internet site to decide your eligibility.

- File a Tax Return: Ensure you’ve got filed a federal profits tax go back for either 2019 or 2020. If you don’t typically record a go back, you can sign up with the IRS the usage of the Non-filer Sign-up Tool.

- Update Information: Use the Child Tax Credit Update Portal to check the fame of your payments and update any vital data.

Most eligible households will routinely get hold of the monthly payments if they have filed a 2019 or 2020 federal earnings tax go back, used the Non-Filers tool to sign up for an Economic Impact Payment all through 2020, or registered for the Advance Child Tax Credit the use of the Non-filer Sign-up Tool.

Payment Distribution

The CTC monthly payments might be allotted starting from July 15, 2024. Those who’ve installation direct deposit with the IRS will see these bills deposited into their bank accounts on the fifteenth of each month. This ordinary schedule allows households plan their price range better, understanding when to expect the finances.

Steps for Families Not Receiving Payments on Time

If you trust you are eligible for the CTC month-to-month bills but have not received them on time, it’s far endorsed to:

- Wait some business days past the anticipated date.

- Ensure which you have filed a 2019 or 2020 tax go back.

- Check that all essential steps to claim the CTC were completed.

If problems persist, contacting the IRS for explanation and assistance may be important.

The Child Tax Credit for 2024 represents a massive growth in financial help for families with kids. By supplying as much as $300 in line with month for more youthful children and $250 according to month for older kids, the IRS targets to offer full-size alleviation to families, assisting them manage the charges associated with elevating children. The more suitable credit score, part of a broader suite of economic assistance applications, underscores the authorities’ commitment to supporting households at some point of difficult economic instances.

Families should make certain they meet the eligibility standards and entire all necessary steps to obtain these payments. By doing so, they can take full advantage of the financial aid to be had to them, easing the weight of residing fees and imparting a extra stable monetary destiny for their youngsters. For the maximum current and personalized recommendation, it’s miles continually excellent to consult the IRS internet site or a tax expert.