The smallest amount that you can lawfully pay an employee for each hour that they work is the minimum wage. If you’d want, you can pay more than the minimum wage, but you are not allowed to pay less. Since independent contractors are exempt from minimum wage requirements, it is imperative that you accurately define your workforce.

Who Determined The Minimum Salary ?

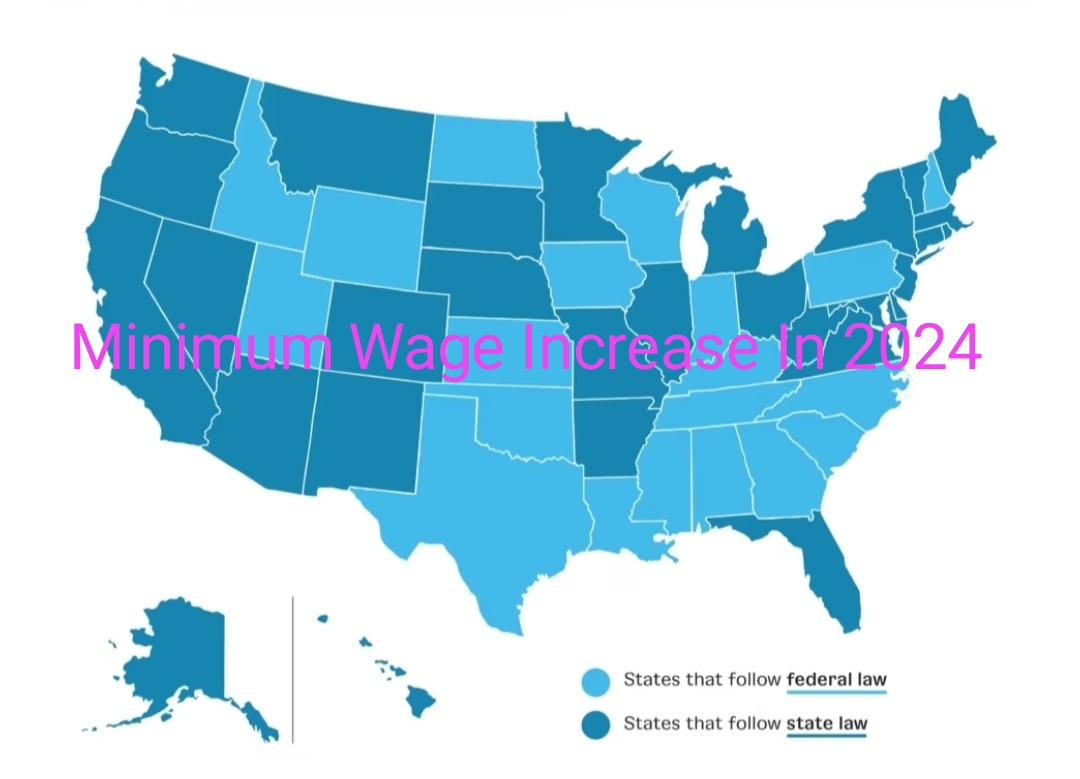

Every employee in the US is entitled to a standard minimum salary determined by the federal government. Nevertheless, minimum wage rates may also be set by municipalities and states. States’ minimum wages differ from local ones. You are required to pay your employees at least the federal minimum wage rate if the state or local minimum wage is less than the federal minimum wage.

What happens if the minimum wage is raised locally or state-wide? Pay your employees the state or local minimum wage, whichever is higher, if it is higher than the federal minimum wage. Pay your employees the greatest rate possible while making decisions about minimum wage legislation at the local, state, and federal levels.

What Is The Federal Minimum Wage ?

The Fair Labour Standards Act (FLSA) establishes the federal minimum wage, which is upheld by the Department of Labour (DOL) of the United States. The federal minimum wage has not increased since 2009, despite the fact that it is flexible.

What is the minimum wage in the country, then? The federal minimum wage as of right now is $7.25 per hour. However, in the years to come, there’s a chance that the federal minimum wage will rise.

Nobody wants to pay fines totaling thousands of dollars. However, if you are unaware of all the FLSA regulations, you may end yourself breaking them and having to pay expensive fines. See our FLSA Cheat Sheet white paper for free to learn about FLSA regulations, obtain essential resources, and more.

A Local Minimum wage

A local minimum wage that varies from state or federal rates is established by certain cities and counties. Larger cities are where local salaries are more prevalent. If the local minimum wage differs from the state minimum wage, employers are required to pay the highest of the two rates. As of July 1, 2023, the minimum wage in San Francisco is $18.07 per hour.

As of July 1, 2023, the minimum wage in San Francisco is $18.07 per hour. Because San Francisco’s base wage exceeds both the state and federal minimums, employers are required to pay employees at least that amount.

New York is yet another illustration. In the majority of the state, employers are required to pay a minimum wage of $15 per hour. On the other hand, the minimum wage in NYC, Westchester, and Long Island is $16.00 per hour.

The Minimum Pay For Workers

Workers who get tips Currently, tipped employees’ federal minimum wage is lowered by the tip credit allowed by the FLSA. Because tips should cover the remaining portion of an employee’s pay, tipped workers may be paid less than minimum wage. As of right now, the federal tipped minimum wage is $2.13. This pertains to staff members who receive tips totaling more than $30 per month.